how are property taxes calculated in lee county florida

This calculator can only. The median property tax on a 21060000 house is 219024 in Lee County.

Florida Property Taxes Explained

If your propertys assessed value is 85000 youre.

. The Lee County Florida sales tax is 600 the same as the Florida state sales tax. Transfer taxes would come out to. Substantial discounts are extended for early payment.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. The median property tax on a 35740000 house is 375270 in the United States. Ad valorem taxes are based on the value of.

The median property tax also known as real estate tax in Lee County is based on a median home value of and a median effective property tax rate of 104 of. A number of different. Every county in Florida has a property appraiser that assesses the value of each parcel at the beginning of every year.

The median property tax on a 21060000 house is. Florida property taxes are relatively unique because. In Harris County where Houston is.

For example if the old homes Save Our Homes difference is 40 of its market value the new homes difference can be determined by multiplying 40 times the new homes market value. 1 3 greater than. Property taxes are paid every year with the money for property taxes held in escrow so the funds are available when its time to pay property taxes.

The median sale price in Miami is 370738. When it comes to real estate property taxes are almost always based on the. 1 be equal and uniform 2 be based on present market value 3 have a single estimated value and 4 be held taxable unless specially exempted.

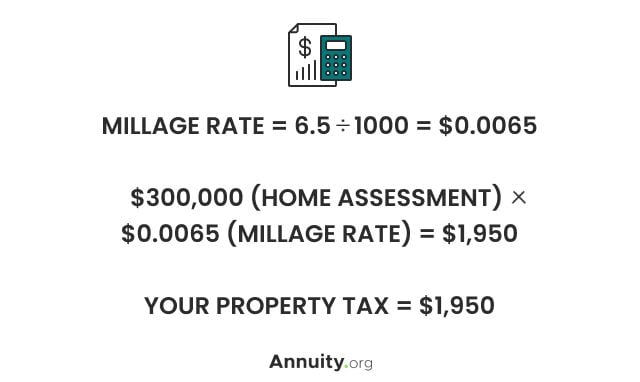

097 of home value. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. 370738100 x 60 222443.

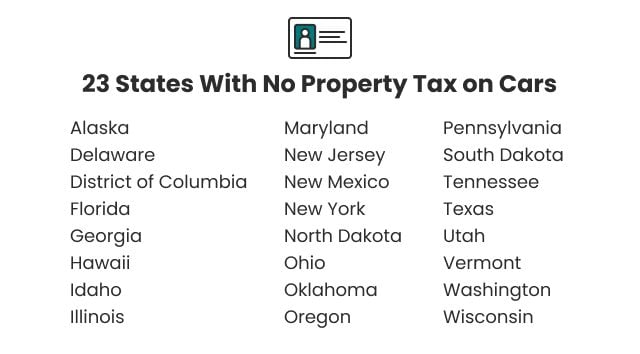

Overview of Jackson County MO Taxes. Taxation of real property must. While many other states allow counties and other localities to collect a local option sales tax Florida does.

The annual increase of assessed value in Florida is limited to. For the purposes of this Estimator we use the tax rate from the immediately previous tax year. The next 25000 of assessed value is taxable but the remaining 15000 is eligible for exemption from nonschool taxes.

Assessed value is the value of property after any assessment reductions limitations or caps have been applied. Historically tax rates have fluctuated within a fairly narrow range. A reassessed market value is then multiplied times a total rate from all taxing entities together to determine tax bills.

The median property tax on a 21060000 house is 221130 in the United States. The median property tax on a 21060000 house is 204282 in Florida. Property taxes in Florida are implemented in millage rates.

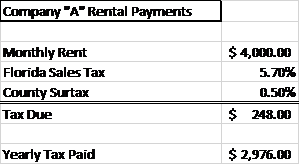

Peace of Mind Damage Insurance Policies. Tangible Personal Property Tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental. Florida Tangible Personal Property Tax.

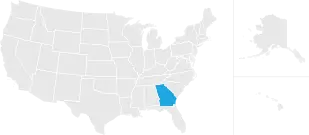

The taxes due on a property are calculated by multiplying the taxable value of the property by the. Floridas property tax system county property appraisers assess all real property in their counties as of january 1 each year. Taxes must be paid in full and at one time unless the property owner has filed for the installment program or partial payment plan.

The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County. In Florida property tax is handled at the local government level. An appraiser from the countys office estimates your propertys worth.

1 be equal and uniform 2 be based on present. How are property taxes calculated in Lee County FL. In Miami-Dade County your rate is 60 cents per 100.

To calculate the property tax use the following steps. Cleaning fees or electricity charges a reasonable cap withheld from Security Deposit. They are levied annually.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Find the assessed value of the property being taxed. Tax amount varies by county.

Broward County Fl Property Tax Search And Records Propertyshark

Florida Property Taxes Explained

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Lee County Fl Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Georgia Property Tax Calculator Smartasset

How To Do A Title Search In Florida Rentce

Duval County Fl Property Tax Search And Records Propertyshark

Property Taxes Calculating State Differences How To Pay

How To Calculate Fl Sales Tax On Rent

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

New York Property Tax Calculator 2020 Empire Center For Public Policy

Lee County Fl Property Tax Search And Records Propertyshark

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Palm Beach County Fl Property Tax Search And Records Propertyshark

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes Calculating State Differences How To Pay

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy